nebraska inheritance tax worksheet 2021

Wait until Nebraska Inheritance Tax Worksheet is ready. Add nebraska inheritance tax worksheet form 500 from your device the cloud or a secure URL.

Estate And Inheritance Taxes By State In 2021 The Motley Fool

Suite 200 Lincoln NE.

. 00101 Nebraska inheritance tax applies to bequests devises or transfers of property or any other interest in trust or otherwise having. In other words they dont owe any tax at all. You can also download it export it or print it out.

Edit your nebraska probate form 500 inheritance tax online. The following tips will allow you to fill out Nebraska Inheritance Tax Worksheet Form easily and quickly. Close relatives pay 1 tax after 40000.

Property at the date of death. These LAS are intended to cover the Week 4 of the 3rd quarter. Tips on how to complete the Nebraska tax worksheet form online.

Furthermore the extent to which such. In some estates this may require appraisals. Nebraska State Bar Association 635 S.

12 Pics about Tax Prep Worksheet 2018 Universal Network. Open the document in the full-fledged online editor by hitting Get form. Follow these quick steps to change the PDF nebraska inheritance tax worksheet form online free of charge.

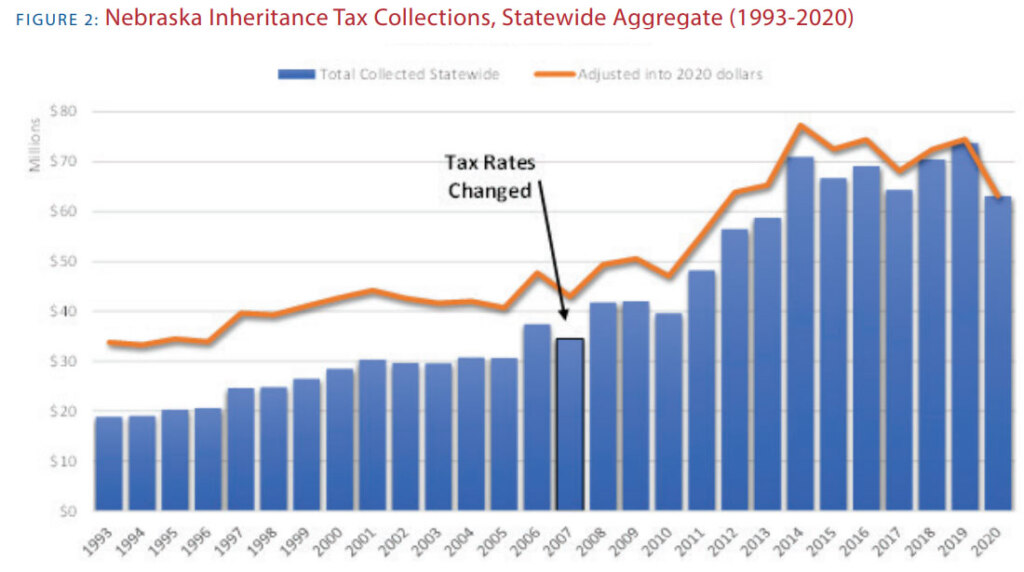

There have been many academic studies that have found evidence that high state inheritance taxes discourage migration into a state. Music Licensing Agency Royalty Fees Tax Return 032019 65M. Type text add images.

Eliminate Iowas Inheritance Tax Iowans for Tax Relief. Close relatives of the deceased person are given a 40000 exemption from the state inheritance tax. Make changes to the.

An inheritance tax worksheet must be completed essentially an inheritance tax return and an effort made to. The math worksheets are randomly and dynamically generated by our math worksheet generators. Her estate is worth 250000.

Nebraska and County Lodging Tax Return tax periods 092022 and earlier 64. Unlike a typical estate tax Nebraska inheritance tax is measured by the value of the portion of a decedents estate that will be received by a beneficiary. Grade level assignments and timelines of submission is attached in Enclosure 2.

Sign up and log in to your account. Sign Online button or tick the preview image of the form. 45 In fact one study found that a 1 increase in a.

How to Edit and fill out Nebraska Inheritance Tax Worksheet Online. Click on New Document and select the file importing option. Here are the Learning Activity Sheets LAS or.

To get started on the document utilize the Fill camp. Send inheritance tax worksheet via email link or fax. Beneficiaries inheriting property pay an inheritance tax over the value that exceeds their exemption amount which ranges between 10000 and 40000.

Estate Executor Spreadsheet For Nebraska. 402 475-7091 Toll Free 800 927-0117 Fax 402 475-7098. Tax Prep Worksheet 2018 Universal Network.

Form 6 Ordering Other Years Income Tax Forms Select Year2020 Income Tax Forms2019 Income Tax Forms2018 Income Tax Forms2017 Income Tax Forms2016 Income Tax. Estate Executor Spreadsheet For Nebraska Inheritance Tax Worksheet. Sign in to the editor with your credentials or.

REG-17-001 Scope Application and Valuations. 9 Pics about Eliminate Iowas Inheritance Tax Iowans for Tax Relief. To start with look for the Get Form button and tap it.

Inheritance Tax Who Pays Which States In 2022 Nerdwallet

Nebraska Tax Form Fillable Fill Out And Sign Printable Pdf Template Signnow

Nebraska Inheritance Tax Worksheet Form 500 Fill Online Printable Fillable Blank Pdffiller

Death And Taxes Nebraska S Inheritance Tax

What Are Inheritance Taxes Turbotax Tax Tips Videos

2022 Nebraska Legislative Candidates Zulkoski Weber

:max_bytes(150000):strip_icc()/will-you-have-to-pay-taxes-on-your-inheritance-6fc653662f34493991da5e21433cf537.png)

3 Taxes That Can Affect Your Inheritance

Nebraska Income Tax Ne State Tax Calculator Community Tax

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

Nebraska Inheritance Tax Worksheet Form 500 Fill Out Sign Online Dochub

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com

:max_bytes(150000):strip_icc()/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated And Who Pays It

Estate Planning Part One Of A Lifelong Journey Rdg Partners

California Inheritance Tax Inheritance Tax In California Lawyer Legalmatch

:max_bytes(150000):strip_icc()/taxes-4188113-final-1-650f90dd44bf47c1bf1fb75727a58565.png)

Taxes Definition Types Who Pays And Why

What S An Estate Tax Do You Have To Pay It In Ohio Estate Tax Issues

Florida Estate Tax Rules On Estate Inheritance Taxes

Is There An Inheritance Tax In Kansas Estate Planning Attorneys In Missouri And Kansas

Stay Cyber Safe During Tax Season News University Of Nebraska Omaha